Why more Chinese investors are turning to Thailand

為何中國投資客轉戰泰國?

Restrictions placed in Australia is resulting in increased Chinese interest in Thailand.

澳洲的各種限制,讓中國人增加對泰國投資的興趣

It is certainly not new news that the Chinese investors are purchasing property in Thailand. Often choosing the Kingdom for a variety of reasons such as the promising returns on offer plus the attractive price point. However there is a renewed appetite from the Chinese. This is believed to be a result of restrictions introduced in Australia to curb overseas investors from purchasing property.

中國投資客在泰國大肆買房已經不是什麼稀奇的事情,造成這股風潮的原因,不外乎就是未來可觀的發展性,及便宜又大碗的性價比。除此之外,澳洲最近新增的諸多房地產限制,讓外國投資客望之卻步的同時,也為泰國增加了一個新的吸力。

Australia has become a popular investment destination for the Chinese because many want property for their children to reside in whilst studying in the country. Additionally they wish to spread their investments across a variety of assets. Hence Australia’s stability and security nature is attractive.

中國人熱衷在澳洲投資,是因為他們希望自己的孩子能在澳洲學習、成長,同時,也希望能藉此在不同的領域置產。穩定而安全的澳洲,一直以來是許多中國人的首選。

New taxes

新稅制

However measures introduced to deter overseas investors have had an effect with Chinese investors moving their sights from Australia to Thailand. The state of Victoria, which includes the popular buzzing city of Melbourne, has taken action to aid the slowdown the activities of international investors. Until the 1 July there was an exemption of stamp duty for any off-plan property. This has now been abolished. Plus in 2016 overseas purchasers have been stung even further with a hike in stamp duty from three to seven percent.

然而,新上路的法規阻擋了許多海外投資客的進入,也開始讓中國人放眼泰國市場。擁有繁華城市——墨爾本的維多麗亞州在今年7月1日,將預售項目的印花稅減免正式廢除。雪上加霜的是,2016年開始,海外買家的印花稅從3%上升到7%。,開始讓國外投資客躊躇不前。

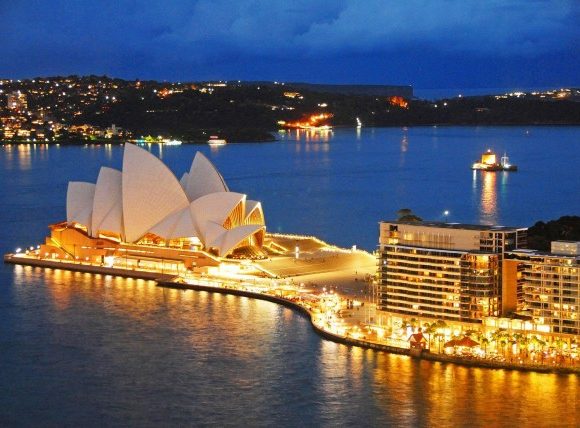

In New South Wales, home to Sydney, a similar pattern has emerged. Foreign purchasers have to pay 8 percent tax on property purchases. Additionally the annual land tax for overseas investors has increased from 0.75 percent to 2 percent. This comes as a result of international investors being cited as a key driver in rising property prices in Sydney where since in 2009 prices have doubled.

在雪梨的所在地——新南威爾斯,類似的情況也漸漸浮現。外國買家必須付8%的稅在物業交易上,另外,外國投資人的年度土地稅也從0.75%漲到了2%。種種稅制讓外國買家需付出的房產價格,從2009年到現今,已足足上漲了1倍之多。

The federal government has also taken action implementing a ‘ghost tax’. This annual fee of AUD 5,000 will be levied on any property that is left empty for a period of six months or more. The aim is to discourage investors from buying property as a means to park their money rather than to live in. In turn it is hoped that it will ensure that locals are still able to afford to buy property. The funds raised from these taxes will then be injected back into the market. Used to help build affordable housing and also to assist first time buyers to reach the first rung of the property ladder.

為了房產的可入手性,為了讓買房新手有機會入手房地產的第一步台階,聯邦政府開始徵收「空屋稅」。「空屋稅」意即,要對所有空置6個月以上的房產,徵收5,000澳幣的年度稅。設置這個稅制的原因,是為了讓房子能發揮它真正的效用,而不再只是一個儲蓄型式。各式各樣的稅制,導致置產成本提升,也全部反映到了市場之中。

Thailand to reap the rewards

泰國獲得意想不到的收穫

As many Chinese investors turn away from Australia in a response to these rising taxes, more are setting their sights on other destinations. Consequently Thailand has received more attention. As a result we expect to see a rise in the number of transactions in the kingdom from Chinese investors going forward as their enquiry levels have already increased.

許多因上漲的稅制而逃離澳洲的中國人,開始重新鎖定目標。因此,泰國獲得了更多的關注,而我們也期待中國客戶在泰國的物業交易量,會隨著需求量一起成長。

資訊來源:www.thailand-property.com

連絡資訊 #泰國房地產 #新陽地產

留言列表

留言列表